Main article

The transition to renewable energy sources and the growth of electromobility are driving an increase in demand for key minerals, including lithium, copper, cobalt, graphite and nickel. These minerals are essential for manufacturing wind turbines, solar panels and the high-capacity batteries used in electric vehicles and energy storage systems, for example (see box 1 on lithium-ion batteries).

Box 1

Advantages and disadvantages of lithium-ion batteries

The performance of lithium-ion (Li-ion) batteries varies depending on the chemistry of their main components (see table 1). These batteries function on the basis of an electrochemical oxidation-reduction (redox) reaction and are usually composed of one or more cells, each with two metal poles (electrodes): the cathode or positive pole and the anode or negative pole. They also contain an ionic conductor (electrolyte) that may be a liquid, solid or hybrid (gel), and a membrane to separate the poles. The cathode may contain varying amounts of lithium and other minerals (cobalt, iron, manganese or nickel) and the anode is usually made of some type of carbon (graphite), but it can also be made of another metal or metal alloy (lithium, tin, silicon or titanium). The ionic conductor usually contains lithium salts, and the dividing membrane is micropermeable to enable lithium ions to circulate between the poles.

Table

Characteristics of Li-ion batteries

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of Battery University, “BU-205: types of Lithium-ion” [online] https://batteryuniversity.com/article/bu-205-types-of-lithium-ion Flash Battery, “Which chemistry is most suitable for the electrification of your vehicle? let’s discover the different types of batteries” [online] https://www.flashbattery.tech/en/types-of-lithium-batteries-which-chemistry-use/; and Y. Miao and others, "Current li-ion battery technologies in electric vehicles and opportunities for advancements", Energies, vol. 12, No. 6, 2019.

Advantages of Li-ion batteries

Li-ion batteries are much more powerful, smaller and lighter than lead acid, nickel cadmium and nickel metal hydride batteries. Because lithium is a lightweight element with a small atomic radius (it is the lightest metal; only hydrogen and helium, which are gases, are lighter), it supports very high voltage and charge storage per unit of mass and volume. At nearly 300 Watt-hours per kilogram (Wh/kg), it is also one of the most energy-dense commercial battery technologies, compared with approximately 75 Wh/kg for alternative technologies. Because Li-ion batteries can supply up to 3.6 volts —1.5 to 3 times the voltage of the alternatives— they are suitable for high-power applications such as transport. They require comparatively little maintenance, and no maintenance schedule is needed to support their useful life. They have no “memory effect”, a damaging process through which batteries gradually “remember” a lower energy capacity if they are repeatedly recharged after being only partially drained. They also have a low self-discharge rate, around 1.5% to 2% per month, and do not contain lead or cadmium, which are toxic.a

Disadvantages of Li-ion batteries

The disadvantages of Li-ion batteries relate mainly to safety. They tend to overheat and can be damaged by high voltage. Damaged batteries can overheat and combust. They require safety devices to limit voltage and internal pressure, which can increase their weight and weaken their performance in some cases. Degradation, cost and safety concerns mean that they are not the best solution for grid-scale stationary energy storage.b

Comparison of Li-ion and sodium-ion batteries

Instead of lithium, sodium-ion (Na-ion) batteries contain small amounts of other critical minerals, with no toxicity issues. Sodium is an abundant, low-cost material that is similar to lithium in physico-chemical terms, since both are highly reactive alkaline metals. Na-ion batteries have clear advantages compared with Li-ion batteries. They may be cheaper, use fewer critical minerals,c be less toxic and safer, and have a longer useful life, which makes their technology more sustainable. However, sodium's higher atomic weight, larger atomic radius and lower redox potential mean that its energy density output is lower (between 100 and 150 Wh/kg), as is its power.d, e

These pros and cons are enough to put Na-ion batteries in the lead in the field of next-generation batteries for stationary storage (for energy from renewable and intermittent sources) and for heavy transport (e.g. ships and trucks), where mass and volume limits are lower and instead the key parameters are safety, useful life and cost. However, existing Li-ion batteries and newer variations (lithium nickel manganese cobalt, lithium nickel cobalt aluminium oxide, solid-state lithium and others), which feature higher energy density and voltage and battery management systems to monitor safety and increase useful life, remain the battery of choice for mobile devices and light transport.

Source: Prepared by the authors, on the basis of Battery University “BU-205: Types of Lithium-ion” [online] https://batteryuniversity.com/article/bu-205-types-of-lithium-ion; Flash Battery “Which chemistry is most suitable for the electrification of your vehicle? let’s discover the different types of batteries” [online] https://www.flashbattery.tech/en/types-of-lithium-batteries-which-chemistry-use/ and Y. Miao and others, "Current li-ion battery technologies in electric vehicles and opportunities for advancements", Energies, vol. 12, No. 6, 2019.

a See [online] https://www.cei.washington.edu/research/energy-storage/lithium-ion-battery/.

b For more information, see [online] https://www.cei.washington.edu/research/energy-storage/lithium-ion-battery/.

c Like Li-ion batteries, Na-ion batteries have cathodes whose components may be made of transition metal oxides, polyanionic compounds (sulfates, phosphates, borates or silicates) or Prussian blue analogues. Anodes are usually made of non-graphitized hard or soft carbon, or Prussian blue analogues. The electrolyte usually contains sodium salts. See [online] https://cicenergigune.com/en/blog/achievements-challenges-sodium-ion-battery-materials.

d For more details see [online] https://cicenergigune.com/en/blog/sodium-ion-batteries-sustainable-lowcost-energy-storage-technology; https://cicenergigune.com/en/blog/beyond-lithium-technologies-battery-manufacturers.

e Sodium-air batteries, which are still at the research and development stage, could revolutionize stationary storage and electromobility, since theoretically, they are six times denser than Li-ion batteries (1,600 Wh/kg compared to 250 Wh/kg) and, of course, denser than Na-ion batteries. See [online] https://cicenergigune.com/en/blog/critical-role-electrolyte-selection-sodium-oxygen-batteries.

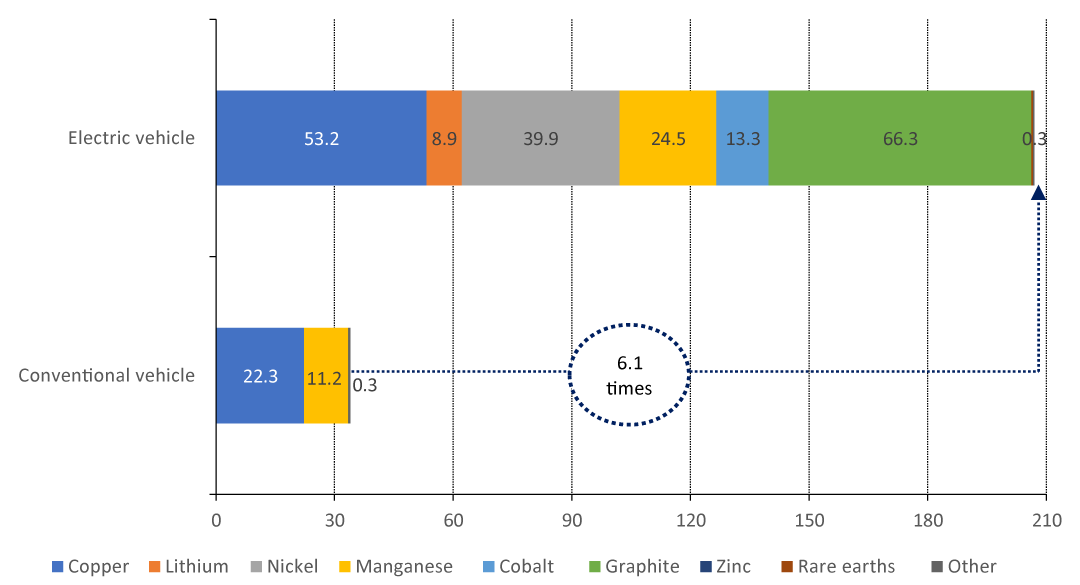

These low-carbon technologies, which are essential for combating climate change, are more mineral-intensive than conventional fossil fuel-based technologies. According to the International Energy Agency (2021), electric vehicles consume 6 times more critical minerals than vehicles that run on fossil fuels (see figure 1A), while offshore wind farms and solar photovoltaic power plants require 13 and 6 times more minerals, respectively, than a gas plant of similar size (see figure 1B).

Figure 1

Quantity of minerals used in selected clean-energy technologies

A. Transport

(kg/vehicle)

B. Power generation

(Tons/MWh)

Source: Prepared by the authors, on the basis of International Energy Agency (IEA), The Role of Critical Minerals in Clean Energy Transitions, Paris, 2021.

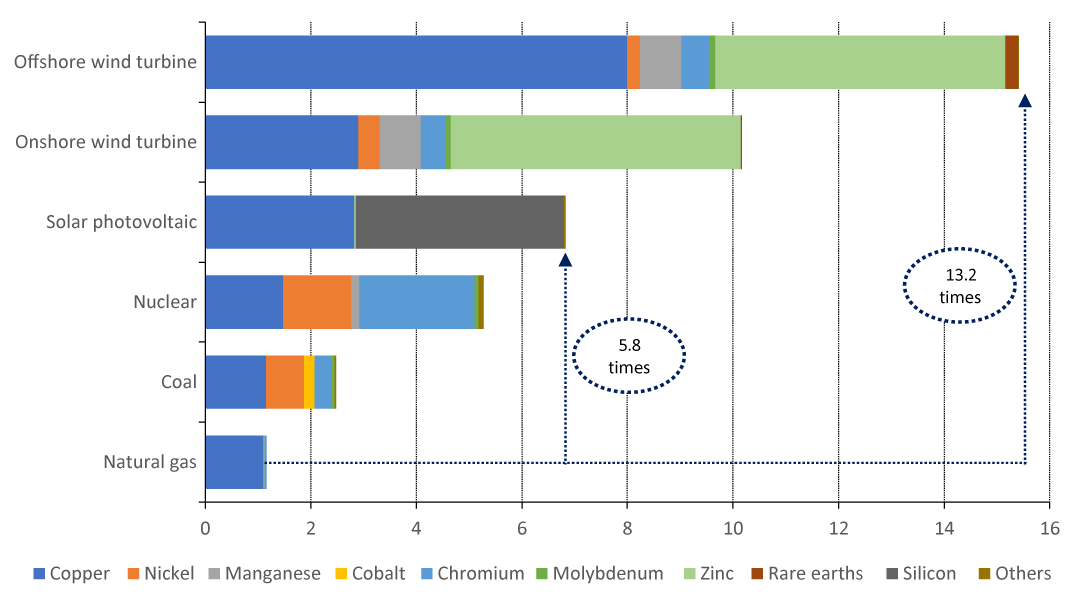

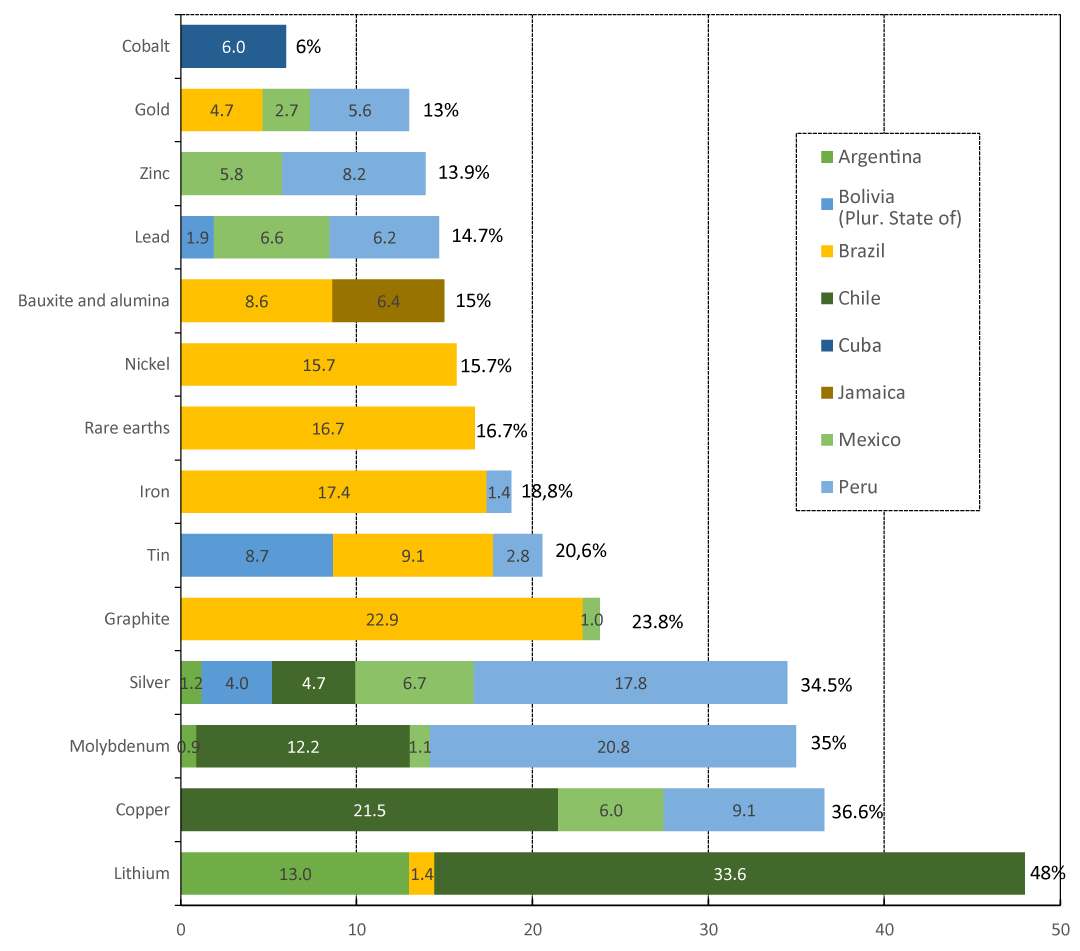

In its publication Net Zero Emissions by 2050 Scenario, the International Energy Agency estimates that global demand for the minerals required for clean energy could grow as much as 17.1 times for lithium, 5 times for cobalt, 6.5 times for nickel, 4.6 times for rare earth metals and 3.1 times for copper (see figure 2). Boosting production sufficiently to meet the growth in demand will require massive investment and the expansion of the mining frontier to territories with resources that have yet to be exploited. In light of the increasing strain on communities and ecosystems from mining activities, it is essential for the region’s countries to establish a strategic vision, appropriate economic, social and environmental regulations and enhanced coordination.

Figure 2

Projected demand for selected minerals to 2050

(Multiples of estimated 2023 demand)

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of International Energy Agency, Global Critical Minerals Outlook 2024, Paris, 2023 [online] https://www.iea.org/reports/global-critical-minerals-outlook-2024.

Note: STEPS refers to stated energy policies scenario and NZE refers to net-zero emissions by 2050 scenario. Supply (demand) increases by a certain factor (multiples of demand = [demand in 2050/production in 2023] to cover clean energy requirements: electric vehicles, battery storage and other uses).

Growth in the demand for these minerals will hinge on how fast countries adopt renewable energy technologies and electromobility. For example, lithium demand today is largely driven by electric vehicle battery technologies. However, demand for many minerals will also continue to be driven by other technologies.

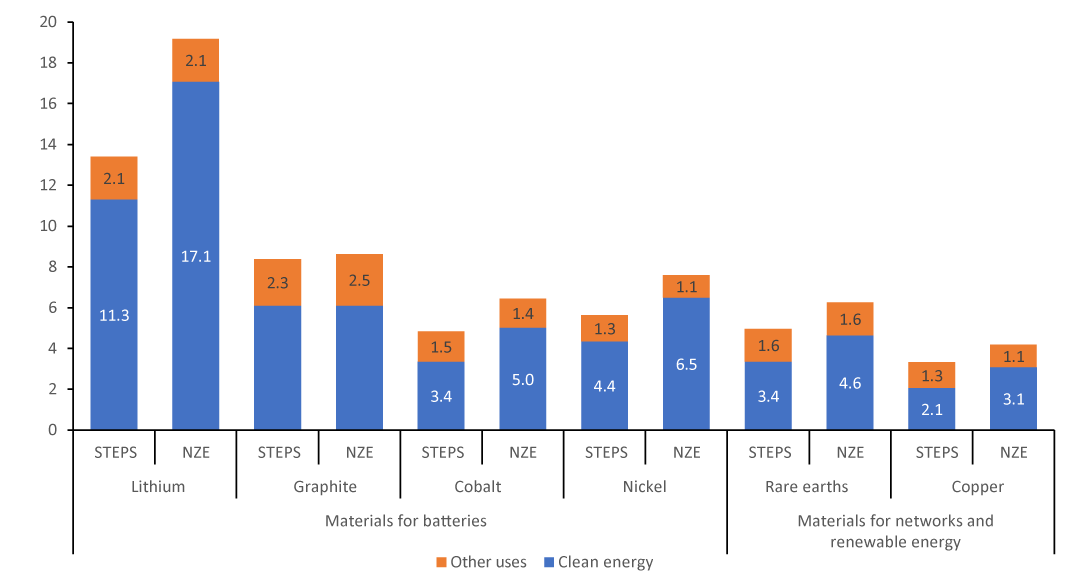

The mining industry of Latin America and the Caribbean can contribute to the global supply of several of these critical minerals. The region has significant reserves of lithium, copper, nickel, molybdenum, graphite and other minerals. Chile has reserves of lithium and copper; Peru has copper and molybdenum; Brazil has lithium, graphite and rare earth metals; and Mexico has copper (see figure 3).

Figure 3

Latin America and the Caribbean (5 countries): share of selected global mineral reserves, 2023

(Percentages)

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of statistics from U.S. Geological Survey, Mineral Commodity Summaries 2024, Washington, D.C., 2024.

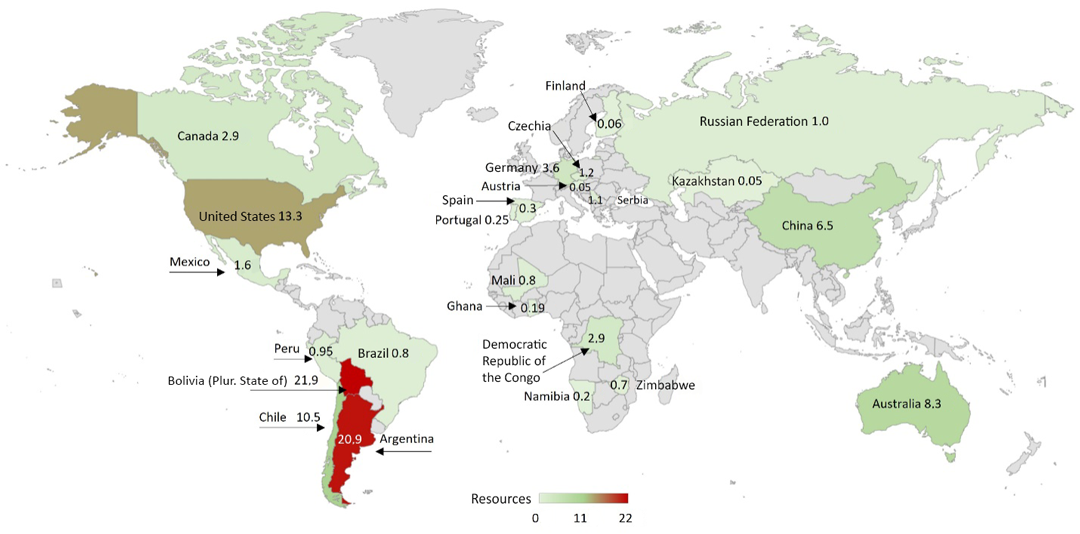

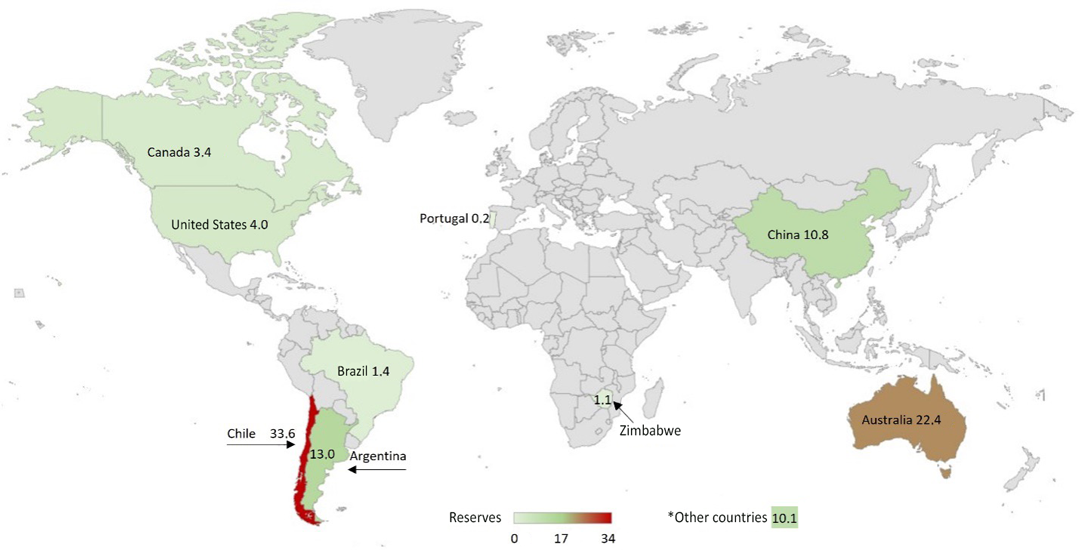

Notably, the region has large deposits and reserves of lithium (see maps 1 and 2). Over the next 10 years, lithium carbonate equivalent production capacity in the region is expected to increase by a factor of 2.7, going by projects that are in the pipeline or classified as probable, and by a factor of 5, when possible and speculative projects are also considered (Jones, Acuña and Rodríguez, 2021).

Map 1

World: share of lithium resources, 2023

(Percentages)

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of statistics from U.S. Geological Survey, Mineral Commodity Summaries 2024, Washington, D.C., 2024.

The following map shows the main countries that have lithium reserves, an essential mineral in the manufacturing of rechargeable Li-ion batteries, now one of the main energy storage solutions in electric vehicles.

Map 2

World: share of lithium reserves, 2023

(Percentages)

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of statistics from U.S. Geological Survey, Mineral Commodity Summaries 2024, Washington, D.C., 2024.

Note: Other countries that have declared reserves include Austria, Czechia, the Democratic Republic of the Congo, Finland, Germany, Ghana, Mali, Mexico, Namibia, Serbia and Spain, which together have 10.1% of global reserves.

The increasing adoption of low-carbon technologies has led to an upsurge in exploration and extraction of the required minerals in various parts of the world in general, and in Latin America and the Caribbean in particular, which poses production challenges and issues of economic, social, environmental and institutional sustainability. In 2022, Chile was the largest producer of mined copper in the world (23.7%) and Peru was the second-largest (10.2%). Among lithium producers, Chile ranked second (30.2%), Argentina fourth (4.8%) and Brazil fifth (1.7%). Chile also ranked second in molybdenum production (17.4%), Peru fourth (12.7%) and Mexico fifth (6.3%).

Responsible mineral supply chain management is critical to ensure a just, effective, inclusive and sustainable energy transition. In particular, mineral production and refining poses significant socioenvironmental challenges, such as water consumption in areas with high water stress and repercussions for biodiversity and the traditional economic activities of the social groups living in surrounding areas. To address these challenges, the mining industry will need stricter regulations and standards that make mining more sustainable and ensure that critical natural heritage is safeguarded.

Appropriate management of socioenvironmental conflicts along with greater transparency and public participation will be crucial for environmental and social sustainability as mining activities increase. The importance of reaching national consensus in that regard is increasingly evident, as. consensus will be critical for avoiding the high cost of winding up operations, which may entail judicial redress, stranded assets and the elimination of the productive networks established, following decisions by the population to oppose mining (see box 2 on socioenvironmental conflicts). In particular, there is a need for proper regulation and implementation of International Labour Organization Convention 169 with regard to the free, prior and informed consent of Indigenous Peoples.

Box 2

Public protests against extractive activities: Panama and Ecuador

In October 2023, after receiving presidential assent, the Congress of Panama passed Act No. 406 on extending the concession agreementa of Minera Panamá S.A., a subsidiary of Canadian mining company First Quantum Minerals, for the largest open-pit copper mine in Central America, triggering protests that paralyzed the country. During its active period (2019–2022), the mine accounted for approximately 1.5% of the world’s annual copper production. The value of copper exports from Panama in 2022 totalled US$ 2.797 billion, accounting for 76.5% of the country’s total goods exports.b However, the mining project has provoked heated debate on mining resource sovereignty and public participation and has triggered environmental impact concerns, as it is located in a densely forested and biodiverse area that is protected as part of the Mesoamerican Biological Corridor.

In an attempt to control the protests, the government declared a national moratorium on metal mining, banning new mining concessions indefinitely.c A little more than a month after the new contract had been signed and amid continuing public protests, the Supreme Court of Panama also rescinded the exploitation permit, declaring that the contract was unconstitutional.d Since then, the Government of Panama has been working with the company, experts and international organizations to prepare and implement a shutdown plan for the mine. The plan is expected to entail a monthly maintenance cost of between US$ 15 million and US$ 20 million, while the timeline for the shutdown and the party liable for the cost have yet to be determined.e

In Ecuador, public consultations in August 2023 among the inhabitants of the country’s capital city led to a decision to ban artisanal, small-, medium- and large-scale mining operations in the Chocó Andino de Pichincha Biosphere Reserve, a nature reserve north-west of Quito renowned for its diverse flora and fauna. For now, this outcome is not expected to affect a dozen gold, copper and silver mining concessions already granted and in the early phases of exploration. In light of the outcome of the consultation, social movements are requesting a review of the existing concessions and steps to prevent the proliferation of illegal mining in the region.

Ecuadorians also decided during the same public consultation to keep the oil of the 43-ITT oil block in the ground indefinitely. It is located inside Yasuní National Park in the Ecuadorian Amazon, a biodiversity hotspot which is also home to Indigenous Peoples living in voluntary isolation. According to a ruling by the country’s Constitutional Court on 9 May 2023, a gradual, orderly cessation of all oil extraction activities in the block was to take place no more than one year after notice was issued of the official results of the consultation, an effective deadline of 31 August 2023. According to the Central Bank of Ecuador, in 2022, the average oil production of block 43-ITT was 50,600 barrels per day, with revenues equivalent to nearly 1% of the country’s GDP. On 8 May 2024, through Executive Decree 257, the President established the Committee for the Execution of the Popular Will of the Yasuní ITT, to fulfil the will of the people regarding the gradual, orderly cessation of all oil extraction activities in block 43. The Decree orders the Committee to draw up a plan of action, although no deadlines are established for its preparation and execution. The Central Bank estimates that the cost of dismantling the mine and covering social benefits and other expenses will be US$ 2.670 billion.f

Source: Prepared by the authors, on the basis of official information.

a The concession was approved by the Congress of Panama on 20 October 2023 and published as Act 406 of 2023. See [online] https://www.gacetaoficial.gob.pa/pdfTemp/29894_A/101138.pdf.

b Data are from the statistical report of the Ministry of Commerce and Industry of Panama. See [online] https://intelcom.gob.pa/informe/resumen-estadistico-del-desempeno-de-las-exportaciones-de-bienes-de-panama-en-2022.

c The moratorium was implemented through Act 407 of 2023, passed on 3 November by the National Assembly with presidential assent. For more information, see [online] https://www.gacetaoficial.gob.pa/pdfTemp/29904/GacetaNo_29904_20231103.pdf.

d The ruling of the Supreme Court of Panama is dated 27 November 2023, and was published in the country's Official Gazette on 2 December 2023. See [online] https://www.gacetaoficial.gob.pa/pdfTemp/29922/GacetaNo_29922_20231202.pdf.

e See J. Lorinc, “First Quantum suspends dividend payments and sells mine after winding up operations in Panama”, 16 January 2024 [online] https://www.bloomberglinea.com/latinoamerica/panama/first-quantum-suspende-dividendos-y-vende-minas-tras-cese-de-operaciones-en-panama/.

f At the time of the consultation, the Central Bank of Ecuador published a series of economic studies on the impact of petroleum activities in block 43-ITT. See [online] https://www.bce.fin.ec/publicaciones/editoriales/evolucion-e-impacto-en-el-rendimiento-petrolero-del-bloque-43-itt.

Better management of the tax revenues and expenditures relating to the exploitation of mining resources can support productive diversification and value addition. Taxation must be more progressive, efficient and equitable to boost the economic rent from minerals. This rent must also be better distributed and used so that it can support an inclusive and sustainable production agenda, with resources allocated, for example, to building technological and productive capacity and infrastructure to add value, developing productive linkages and scaling up global value chains, as well as to research and development (R&D) to provide the knowledge required to spur innovation.

The region offers opportunities for productive development of the minerals and technologies critical to the energy transition at all points of the value chain. As energy system decarbonization gains ground, countries that supply essential minerals are presented with unique opportunities to avoid being confined to the early stages of development of transition technology value chains. These opportunities are not only upstream —in mining activities themselves— but also downstream, from mineral refining to industrialization through to intermediate or final products. The opportunities in the copper and lithium industries are a case in point. Refined copper is used to produce alloys and intermediate products, such as wires, pipes, cables and valves, which may be components or parts in other products like electric vehicles, solar panels and wind turbines.

Countries that produce minerals like lithium have an opportunity to diversify, add value and become bigger players in the production chains for Li-ion batteries, their precursors and refined minerals (ECLAC, 2023). In the case of lithium brine, lithium carbonate and lithium hydroxide can be produced from lithium chloride concentrate, with varying degrees of purity based on industry needs. Through industrial chemical processes, these compounds can then be combined with others, for example to obtain cathode active materials, which are components of rechargeable lithium batteries (see box 3 for examples of initiatives to add value in the region).

Box 3

Lithium industry initiatives for adding value in the region

In Chile, Corporación de Fomento de la Producción (CORFO), a State-owned entity responsible for lithium exploitation contracts in the country, fosters initiatives that add value through an instrument that reserves a quota of lithium carbonate and lithium hydroxide production at preferential prices based on a clause in the contracts managed with SQM and Albemarle, the companies that operate the two lithium extraction and refining projects in the Atacama salt flats. This preferentially priced quota is allocated to companies interested in developing higher value added lithium projects, after CORFO issues specific calls for tenders.

Two Chinese companies, BYD and Yongqing Technology Co, were recently awarded preferentially priced quotas of lithium carbonate by CORFO. BYD plans to set up a factory to produce up to 50,000 tons per year of lithium iron phosphate cathode material (LiFePO4, for lithium iron phosphate (LFP) batteries), investing some US$ 290 million and creating 500 jobs by the end of 2025.

Over the same time frame, Yongqing Technology Co is planning to establish an LFP cathode material plant, with an annual capacity of 120,000 tons, investing US$ 233 million and generating 668 jobs. Both initiatives include a plan to train local personnel to operate these specialized plants.

In Brazil, BYD has announced that it will build three new factories as it expands its operations in Latin America, including a cathode material plant and its first electric vehicle factory outside Asia, with an estimated investment of nearly US$ 620 million and production capacity of 150,000 vehicles per year.

Source: Prepared by the authors, on the basis of official information.

Amid the climate emergency, commodity-dependent developing countries should innovate and diversify production in a way that avoids increases in fossil fuel use and greenhouse gas emissions, issues that have traditionally dogged diversification efforts (UNCTAD, 2023).

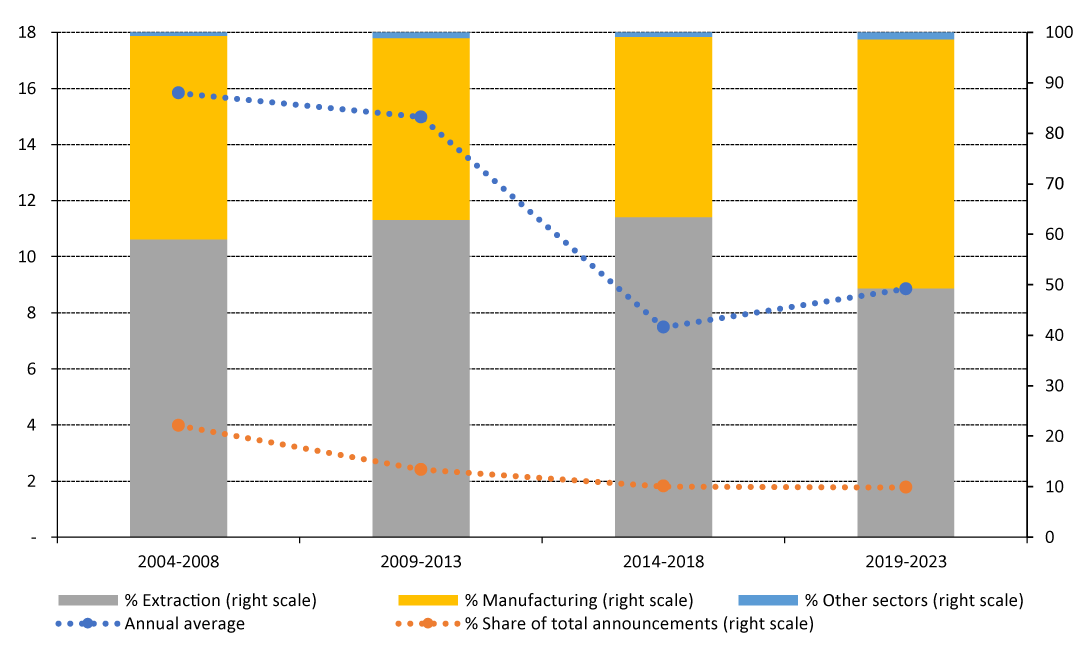

Initiatives to diversify production, such as the development of upstream and downstream hubs and linkages in the mining industry, require investment in the framework of a productive development agenda. However, according to fDi Markets, investment announcements in the region’s mining and metals sector, measured in current dollars, have been trending downward over the last 20 years, both in average annual value and as a share of the total value of announcements. Breaking them down by activity shows that these have been concentrated in extraction. Investment announcements in the sector between 2004 and 2008 averaged US$ 15.8 billion per year and accounted for 22% of the total value. Between 2014 and 2018, following the commodities boom, the average for the sector fell to US$ 7.5 billion —a 50% decline— and its share of the total value of announcements fell to 10%. Most recently, between 2019 and 2023, the annual average for the sector amounted to US$ 8.8 billion, although the sectoral share of the total value of investments announced remained below 10%. Of the announcements in the sector between 2004 and 2018, 62% focused on extraction, just 37% on manufacturing (for example, building plants for processing, smelting and refining), and less than 1% on other activities (including research and development). However, in the most recent period, between 2019 and 2023, announcements were equally distributed between extraction and manufacturing, at over 49% each, while other activities accounted for 1% (see figure 4).

Figure 4

Latin America and the Caribbean (33 countries): investment announcements in metals and minerals sector, by activity, and share of total announcements in all sectors, 2004–2023

(Billions of dollars and percentages)

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of Financial Times, fDi Markets [online database] https://www.fdimarkets.com/.

The region’s agenda for the production of critical minerals for the energy transition will be implemented in a global context in which major economic blocs are implementing a variety of initiatives to support productive and industrial development, which are strongly focused on expanding domestic manufacturing capacity for the technologies needed for the transition to a low-carbon economy. In this global competition, countries are responding with policy strategies such as subsidies, tariffs and other instruments to foster the development of national or regional supply chains, through nearshoring or friendshoring, with neighbouring or allied countries (see table 1).

Table 1

Initiatives in support of productive and industrial development

(Billions of dollars and percentages of GDP)

|

Concept |

China: Made in China 2025 |

United States: Inflation Reduction Act |

European Union: Green Deal Industrial Plan and Critical Raw Materials Act |

Japan: Green Transformation (GX) policy |

Brazil: New Industry Plan |

|

Date |

Launched in 2015 |

Adopted in August 2022 |

Proposed in March 2023 |

Proposed in February 2023 |

Launched in January 2024 |

|

Main objectives |

Strategy to promote technological innovation and reduce dependence on technology imports by developing strategic emerging industries, such as electric vehicles. The strategy is complemented by five-year plans and other policies such as the New Energy Vehicle Industrial Development Plan for the period 2021–2035. |

Federal incentive and spending plan aimed at catalysing investments in domestic manufacturing capacity, encouraging domestic production of critical minerals and procurement from allied countries, and promoting R&D in technologies such as electric cars and Li-ion batteries. |

Set of regulatory and policy measures to increase low-carbon technology manufacturing capacity in the European Union and reduce dependence on imports of manufactures and raw materials. |

Policy to promote investment in decarbonization and accelerate the transition to clean technologies, with targets for carbon neutrality, renewable energies, electrification of transport, and other sectors. |

Set of six “missions” aimed at stimulating the productive and technological development of strategic sectors, including the bioeconomy, the energy transition and transport. |

|

Subsidies and resources |

There is no official information, but it is estimated that hundreds of billions of dollars have been disbursed in direct subsidies, tax incentives and preferential loans in various sectors. |

It is estimated that US$ 391 billion in tax credits and loans have been issued for the green transition in electricity, transport, industry, construction and other sectors. |

Estimated at US$ 288 billion. The extension of the “new crisis and temporary transitions framework” facilitates access to funds by States. |

Seeks to raise investments of US$ 1 trillion over 10 years, starting with the issuance of US$ 144 billion in public bonds, to be complemented by carbon emissions trading schemes and private investments. |

Public investments of approximately US$ 60 billion up to 2026. |

|

Provisions on nearshoring investments and critical mineral supply |

Mandated an increase in the domestic content of key components and materials to 40% by 2020 and 70% by 2025, and domestic sourcing of electric cars. Does not set specific targets for minerals but has contributed to dominance in the production of minerals and related technologies (accounts for more than 80% of global production of solar panels, 50% of batteries, and is the largest producer of refined products from most minerals). |

Minerals and materials used in the manufacture of batteries and EVs must be produced or recycled in the United States or in countries with free trade agreements, on an incremental basis, at 50% in 2024 and 80% in 2027. |

By 2030, consumption should comprise at least 10% locally produced minerals, 40% components processed in the European Union and 15% materials recycled in the European Union. No third country may supply more than 65% of the annual consumption of any raw material. |

It does not specify requirements as to location of suppliers and allows subsidies for international suppliers of critical minerals. |

Sets goals for national industry share in domestic technology supply (e.g. increase share in the electric bus value chain by 25%); ensure that 95% of machinery used in family farming is produced domestically). |

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of M. Castillo, I. Garcés and R. Furtado Messias, “Perspectivas de desarrollo de las cadenas de valor relacionadas con el litio en Chile y América del Sur”, Natural Resources and Development series, No. 223 (LC/TS.2024/38), Santiago, ECLAC, 2024; Center for Strategic and International Studies (CSIS), “Critical questions by Scott Kennedy. Made in China 2025”, 2015 [online] https://www.csis.org/analysis/made-china-2025; G. Yeung, “Made in China 2025’: the development of a new energy vehicle industry in China”, Area Development and Policy, vol. 4, No. 1, 2019 y EIU, “The global green subsidy race. How is it reshaping climate policy and geopolitics?”, 2023 [online] https://www.eiu.com/n/campaigns/global-green-subsidy-race/.

Geopolitical tensions among industrialized countries because of the need to secure the supply of critical minerals for the energy transition present an opportunity for the region, for example in increasing mineral smelting and refining capacity. New smelting and refinery facilities could entail the transfer of cutting-edge technology that meets high environmental standards and provides a competitive advantage, given that new facilities must be carbon-neutral and align with the circular economy to reclaim or safely dispose of waste. These installations could also serve as R&D laboratories for developing new, more complex concentrate processing methods (Lagos and others, 2021).

However, most of the region has focused on mining rather than smelting and refining. Importantly, most of the copper reserves in the region’s countries are primary copper sulfide, which requires smelting and refining. In contrast with smelting capacity in the region, which is stagnating, the production of copper concentrates has increased.1 Between 2010 and 2019, concentrate exports, mainly destined for the Asian market, increased by 128% in Brazil, 89% in Chile, 276% in Mexico and 170% in Peru. In terms of regional productive and technological capabilities, this implies a decrease in scientific research, in the development of new technologies, and in innovation for concentrate smelting and refining, as well as a failure to take advantage of the potential of refinery productive chains and industrial clusters.

One point in favour of boosting smelting and refining capacity in the region is that the carbon footprint of transporting concentrates is some 45% higher than that of cathode production.2 In addition, the electricity systems of the countries of the region (Brazil, Chile and Peru) have a lower carbon footprint than those of Asian countries.

Critical minerals for the energy transition: technical, operational, political and prospective (TOPP) capabilities in the sector

The region’s mining sector faces the challenge of participating in the mining cycle of minerals that are critical for the global energy transition. Seizing the opportunities and overcoming the challenges will require a new governance model for non-renewable natural resources. It must span the entire mining life cycle and be multilevel, transparent, democratic and effective, while also taking a territorial approach (ECLAC, 2024).

The technical, operational, political and prospective (TOPP) capabilities of mining sector institutions need to be strengthened for public policy implementation to be effective and make a greater contribution to transforming extractive activities and development models in the countries of Latin America and the Caribbean (Salazar-Xirinachs, 2023). Table 2 lists some key TOPP capabilities that must be established or strengthened in the mining sector in Latin America and the Caribbean.

1 Copper ores are generally processed in one of two ways, depending on their composition. Copper sulfides are processed using flotation (a traditional method), which yields concentrates. Concentrates must be smelted and then electrorefined to produce cathodes. Copper oxide ore processing involves hydrometallurgy, and consists of heap leaching, solvent extraction, and electrowinning to obtain cathodes. In 2020, 82.9% of the world’s mined copper was refined using flotation, while the remaining 17.1% was processed using hydrometallurgy (Lagos and others, 2021).

2 This assumes that the sulfuric acid generated during smelting is consumed in the same or a nearby operation, so that its transportation footprint is very small.

Table 2

Technical, operational, political and prospective (TOPP) capability initiatives for mining development

|

TOPP |

Actors |

Description and objectives |

|

Technical |

||

|

R&D for sustainable extraction technologies |

Mining companies and academic institutions |

Foster R&D in technologies that minimize the environmental impact of mining and boost resource efficiency, such as green and low-impact mining techniques. This requires that strategic planning include water recycling systems, reduced gas emissions and efficient mining waste management. |

|

R&D and innovation in mineral processing |

Mining companies and academic institutions |

Implement and improve processing technologies that boost efficiency and reduce waste. This includes the development of critical mineral processing methods with a lower environmental impact and reclamation of by-products. |

|

R&D for recycling and reuse technologies |

Mining companies and academic institutions |

Encourage research on and implementation of advanced technologies for recycling the components of energy transition technologies, such as batteries and electronic components, to reduce demand for virgin raw materials. |

|

Learning about critical minerals for the energy transition and applying the knowledge |

Governments and academic institutions |

Strengthen training and education of officials and academics in areas related to mining, energy and the production of critical minerals and their relationship with energy transition technologies, critical mineral supply chains and energy transition technology value chains. |

|

R&D, innovation and technology transfer for energy transition technologies |

Businesses, academic institutions and mining companies |

Generate and encourage R&D, innovation and technology transfer in the use of energy transition technologies, such as wind turbines, solar panels, electric vehicles, and batteries and their components, to create a national or regional technological knowledge base and reduce dependency on other countries and regions. |

|

Operational |

||

|

Integrated supply chain management |

Mining companies, government, academic institutions, civil society and communities |

Establish traceability and certification systems that ensure mineral supply chain sustainability, from extraction to manufacturing and recycling of end products. This includes regulatory amendments, the adoption of international standards, and transparent processes. |

|

Development of mining clusters |

Mining companies, educational institutions, government agencies and local communities |

Foster competition, innovation and sustainable economic growth in the mining sector by establishing mining clusters with technology, service and education providers, encouraging collaboration and knowledge-sharing in the region among mining companies, educational institutions, government agencies and local communities. |

|

Strengthening of production chain sustainability |

Mining sector, mining companies, educational institutions and government agencies |

Foster national and regional linkages between the mining industry and other industrial and service sectors, including manufacturing, energy transition technology, and new information and communications technology, to enable them to access new markets and improve production practices to increase market share and scale up technology value chains. Strategies may also be established to incorporate social and environmental factors, targeting sustainability in chain management. |

|

Strengthening of citizen participation and consultation with communities and Indigenous Peoples |

Civil society and local communities |

Establish clear and effective procedures and methods for citizen participation and consultation with Indigenous Peoples for free, prior and informed consent to increase social licence and reduce socioenvironmental conflict. |

|

Political |

||

|

Development of responsible and sustainable mining policies |

Mining companies, government, academic institutions, civil society and communities |

Develop and update regulatory frameworks to encourage the design and implementation of responsible and sustainable mining policies and practices, including environmental protection and respect for human rights, ensuring free, prior and informed consent, access to information, and public participation in mining project oversight. |

|

Good practices to improve socioenvironmental conflict prevention and management |

Mining companies, government, academic institutions, civil society and communities |

Create effective conflict prevention and resolution mechanisms that include public consultation and good practices across all stakeholder relationships, fostering dialogue and negotiation to prevent and mitigate the negative impacts of mining on communities and the environment and reduce socioenvironmental conflict. Promote principles and instruments for environmental, social and cultural management, environmental justice, respect for Indigenous Peoples and citizen participation . |

|

Strengthening of transparency and access to information |

Mining companies, government, civil society and communities |

Strengthen transparency in mining project management and ensure public access to relevant and timely information, fostering accountability and trust between society and the mining industry. |

|

Strengthening of regulatory and oversight agencies |

Mining companies, government, civil society and communities |

Strengthen regulatory and oversight institutions to ensure compliance with regulations and continuous due diligence in bidding, contracting, impact assessment and other processes for mining projects. |

|

Improvement in the capture of economic rents from minerals and the management of tax revenues from mining activities |

Mining companies, government, civil society and communities |

Strengthen tax regimes and tax administration bodies to improve economic rent capture while introducing mechanisms or rules for managing the revenues from mining activities so that resources are invested in capacity-building and in closing gaps in infrastructure, production, technology and human talent. |

|

Prospective |

||

|

Strategic planning for critical mineral mining |

Mining companies, governments and academic institutions |

Develop long-term strategic plans that align critical mineral production with the needs of the energy transition, including assessment of future demand and sustainable production capacity. |

|

Investment in human resources and education |

Mining companies, governments and academic institutions |

Foster professional education and training in key areas for the mining industry and the energy transition, boosting educational and technical training programmes that respond to the sector’s needs. |

|

Development of sustainable financial mechanisms |

Mining companies, governments and financial institutions |

Create and strengthen financial mechanisms to support sustainable mining projects, including green investment funds and sustainable bonds, to ensure the economic profitability and environmental sustainability of mining activities. |

Source: Economic Commission for Latin America and the Caribbean (ECLAC).

Bibliography

BIR (Bureau of International Recycling) (2008), Report on the Environmental Benefits of Recycling, October.

Castillo, M., I. Garcés and R. Furtado Messias (2024), “Perspectivas de desarrollo de las cadenas de valor relacionadas con el litio en Chile y América del Sur”, Natural Resources and Development series, No 223. (LC/TS.2024/38), Santiago, Economic Commission for Latin America and the Caribbean (ECLAC).

CSIS (Center for Strategic and International Studies) (2015), “Critical questions by Scott Kennedy. Made in China 2025” [online] https://www.csis.org/analysis/made-china-2025.

ECLAC (Economic Commission for Latin America and the Caribbean) (2024),Natural Resources Outlook in Latin America and the Caribbean, 2023, 2023 (LC/PUB.2024/4), Santiago

____(2023), “Lithium extraction and industrialization: opportunities and challenges for Latin America and the Caribbean”, Santiago, June.

EIU (2023), “The global green subsidy race. How is it reshaping climate policy and geopolitics?” [online] https://www.eiu.com/n/campaigns/global-green-subsidy-race/.

IEA (International Energy Agency) (2024), “Global Critical Minerals Outlook 2024” [online] https://www.iea.org/reports/global-critical-minerals-outlook-2024.

____(2021), “The Role of Critical Minerals in Clean Energy Transitions”, Paris [online] https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions.

Jones, B., F. Acuña and V. Rodríguez (2021), “Cambios en la demanda de minerales: análisis de los mercados del cobre y el litio, y sus implicaciones para los países de la región andina”, Project Documents (LC/TS.2021/89), Santiago, Economic Commission for Latin America and the Caribbean (ECLAC).

Lagos, G. and others (2021), “Análisis económico de las cadenas globales de valor y suministro del cobre refinado en países de América Latina”, Project Documents Santiago, Economic Commission for Latin America and the Caribbean (ECLAC).

Miao, Y. and others (2019), "Current li-ion battery technologies in electric vehicles and opportunities for advancements", Energies, vol. 12, No. 6.

Salazar-Xirinachs, J. M. (2023), “Rethinking, reimagining and transforming: the ‘whats’ and the ‘hows’ for moving towards a more productive, inclusive and sustainable development model”, CEPAL Review, No. 141 (LC/PUB.2023/29-P), Santiago, Economic Commission for Latin America and the Caribbean (ECLAC).

UNCTAD (United Nations Conference on Trade and Development (2023), Commodities & development report 2023: inclusive diversification and energy transition (UNCTAD/DITC/COM/2023/2), Nueva York.

U.S. Geological Survey (2024), Mineral Commodity Summaries 2024, Washington, D.C.

Yeung, G. (2019), “Made in China 2025’: the development of a new energy vehicle industry in China”, Area Development and Policy, vol. 4 No. 1.